Some parents are fully independent and can live on their own, some need support but can still live their own home or live in a insisted living home, while other need around the clock card of a total care facility.

Many try to go it alone and this can have drastic consequences on both their parents and the caregiver. Check out this series from the PBS show Life Part 2

Life (Part 2) Caregiving - Can caring for an ailing loved one kill you? "Yes," say health professionals. When Baby Boomers care for aging parents, frequently the last person they're thinking about is themselves. This can be deadly.

Check out the video and website for more information >>

Life (Part 2) Caregiving - Can caring for an ailing loved one kill you? "Yes," say health professionals. When Baby Boomers care for aging parents, frequently the last person they're thinking about is themselves. This can be deadly.

Check out the video and website for more information >>

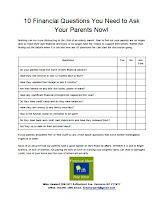

This article provided by Mike Hassard. For ideas on financial concerns surrounding aging, downsizing go to my personal blog http://mikehassard.blogspot.com.